What are the new 1099-K Guidelines?

A massive change is coming to the gig economy for the 2022 tax year. New 1099-K guidelines will impact millions of independent contractors and the businesses that pay them. Anyone who processes credit cards or other electronic payments for contractors like cash is likely to feel the impact. Here’s what changes are coming, how they impact the gig economy for employers, and what you can do to avoid any potential fines for non-compliance.

What is a 1099-K?

The IRS developed the 1099-K to address a staggering problem: taxpayers in the United States were underpaying by nearly half a trillion dollars every tax year. It was introduced in 2012 for payment card and third-party network (marketplace) transaction entities to report credit cards and certain electronic payments. A Treasury Inspector General for Tax Administration (TIGTA) study found that almost two-thirds of income might be misreported when paying entities fail to issue forms. They also found that the tax gap problem is likely to grow.

Who gets a 1099-K?

Anyone who receives cash-like electronic payments can potentially trigger a 1099-K. The list is immense, but some famous examples include gig workers and small-time sellers, such as:

- Uber and Lyft drivers

- Doordash and Grubhub deliverers

- eBay, Etsy, and Shopify sellers

- Airbnb or Bookings.com renters

Payment settlement entities issue the form to contractors who receive credit cards and similar electronic payments and meet the reporting threshold – although that threshold is about to change dramatically. Prior to the 2022 tax year, the criteria for receiving a 1099-K are:

- The payment is settled by credit card processors or third-party payers, such as Amazon or PayPal

- The payee must receive at least $20,000 in the tax year

- The payee has over 200 transactions in a year

What’s changing for the 2022 tax year?

The number of 1099-K recipients is expected to explode for the 2022 tax year. Under the 2021 American Rescue Plan Act, the threshold for triggering a form is radically lowered to only $600 in payments from a single entity. It’s designed to match the 1099-NEC and 1099-MISC reporting thresholds, and U.S. budget officials say it should generate almost $8 billion in taxes over a decade by eliminating the tax gap.

Additionally, the transaction threshold will be eliminated. For example, a single sale for $600 or more will trigger a 1099-K – even if they’re selling something at a loss! Likewise, any cash-like payments made to a contractor that add up to $600 in a single tax year will trigger the form. All third-party settlement organizations (TPSO) and credit card processors who have transactions in the U.S will be required to issue them once the threshold is met.

.jpg?width=1501&name=gigwage_1099K-03%20(1).jpg)

What are the 1099-K penalties?

For issuing entities, they start at $50 per return if you’re less than 31 days late, with a maximum of $556,500. However, they can be as high as $270 per return, with a maximum of over $3 million. Intentional disregard of filing deadlines results in a $550 fine per return – with no maximum penalty at all. The U.S. tax system is technically “voluntary,” which means that it’s up to you (or your accountant) to calculate your taxes and send the proper forms to your contractors – not the IRS.

How can you avoid tax fines for non-compliance?

Most large TPSOs and credit card companies are generally big enough to have a team of accountants already or are contracted with an accounting firm. Therefore, they should expect their paperwork and expenses to increase substantially and plan accordingly.

.jpg?width=1501&name=gigwage_1099K-12%20(1).jpg) The real pain will be for small-to-medium-sized issuing entities. If you’ve done your tax preparation so far, you’re probably going to need tax software or a CPA now. Expect your paperwork to balloon, and with duplication so easy between 1099s, expert help is effectively mandatory. Also, each state has its own 1099-K forms and thresholds, so you’ll need to know the laws of every state where you have independent contractors.

The real pain will be for small-to-medium-sized issuing entities. If you’ve done your tax preparation so far, you’re probably going to need tax software or a CPA now. Expect your paperwork to balloon, and with duplication so easy between 1099s, expert help is effectively mandatory. Also, each state has its own 1099-K forms and thresholds, so you’ll need to know the laws of every state where you have independent contractors.

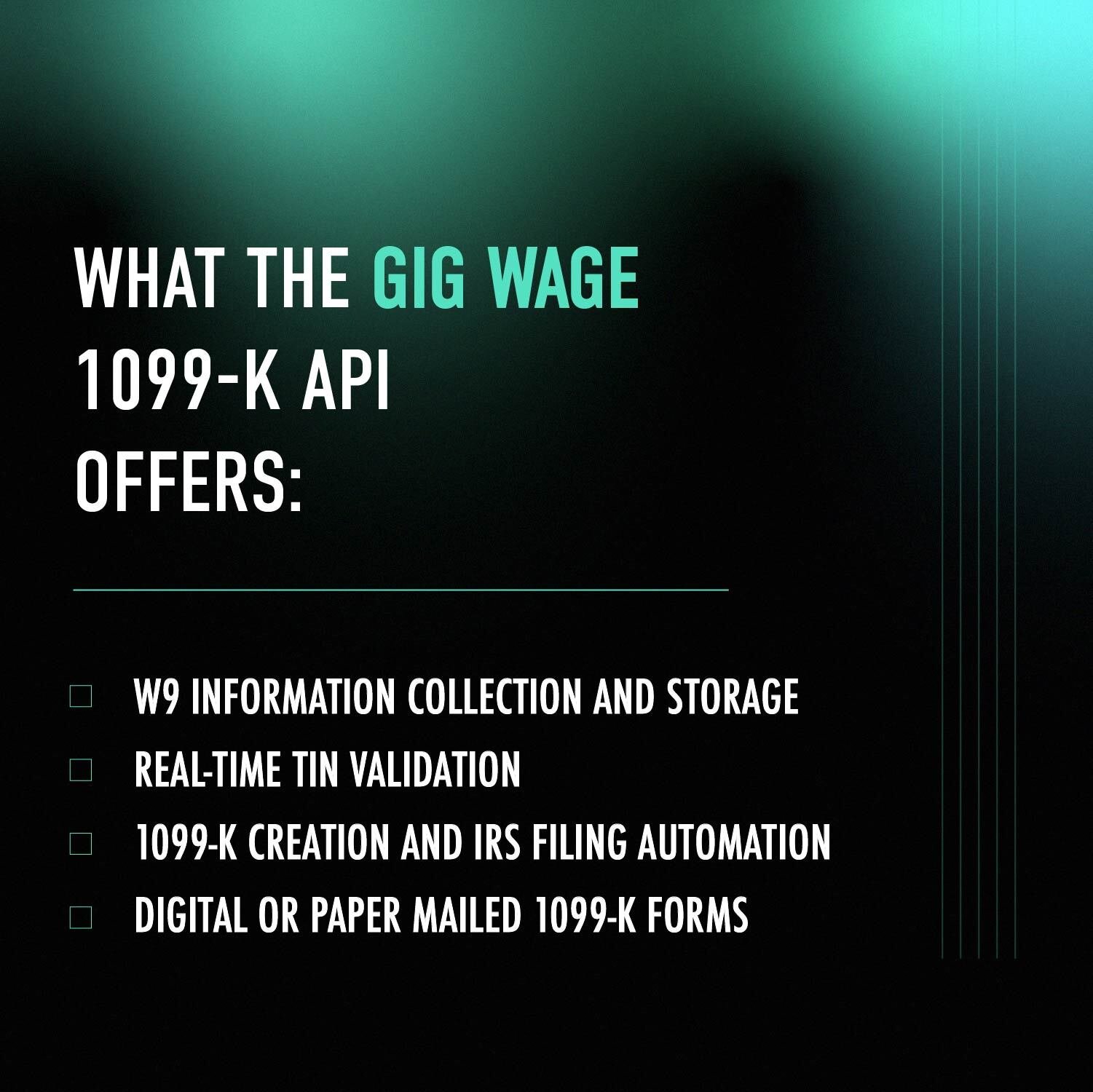

Plus, you’ll need to collect all the taxpayer-identification numbers (TIN) of everyone impacted, so when you onboard most new contractors, you need to send them a W9 form. The W9 is a request for someone’s TIN, so they’ll need to be sent to every contractor who’s impacted by the new threshold. Plus, when the name and TIN don’t match, it’ll be up to you to figure it out. As a legitimate business expense, you can write off all legitimate tax-reporting expenses, of course.

Fortunately, the most cost-effective way to avoid tax penalties is easy: Use integrated software that automatically issues the correct tax forms by the required date. It’s even better when the service integrates payroll, banking, and payments. The time savings alone usually pays for the cost of the benefits – and the sense of relief alone can be priceless.

Another way to avoid fines is to keep your personal and business payments separate. If you use the same account to pay both, it can be challenging to discriminate between the two, and the IRS may consider them too intertwined to separate. Unfortunately, this also will take many by surprise, and the 2022 tax year is expected to be a real headache in the freelance world.

Written by

Erin Lee